Private equity represents forms of investment that consist of buying private companies, typically startup/scaleup from early to pre-IPO stage, before selling them with important returns. They are alternative investments, generally only available to private equity firms through investment funds on behalf of institutional and accredited investors.

ThePlatform.finance deals exclusively with financial Institutions and Qualified investors so typically, we are an excellent partner in the analysis and evaluation of private equity deals. In our experience we have collaborated as analysts for major transactions such as Palantir Technologies, Kraken, Revolut and Epic Games.

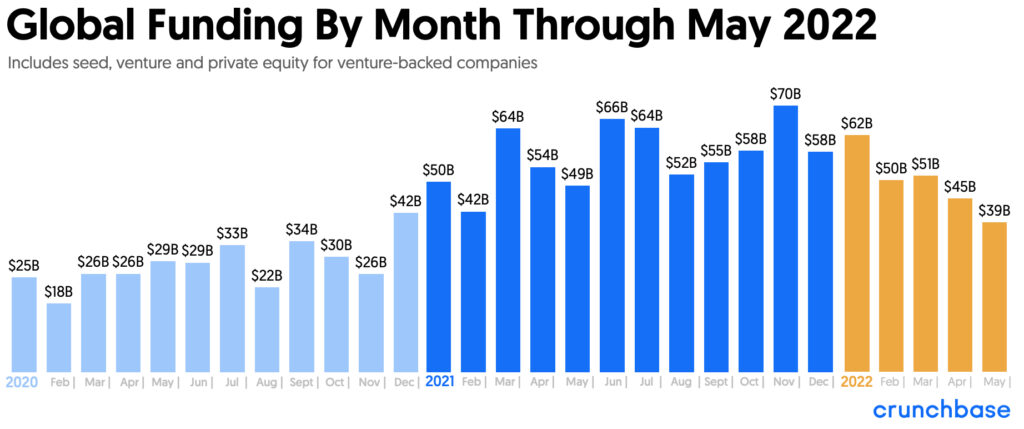

PE and VC dynamics in Q3 2022

At the end of September 2022, long-only investors offloaded almost 25 per cent of the total they sold at the start of the year, selling $51 billion worth of stocks. These phenomena are due to rising inflation, which has led institutional investors to sell securities, especially growth companies.

In a context like the one described and at very low valuations, can these asset classes also represent an opportunity for private investors, not just for institutions?

Can banks and management companies consider these investment opportunities for their final clients?

Private equity has always been inaccessible to retail investors in the UK. It has recently accelerated in the United States and now it is becoming increasingly attractive to individual investors in the UK as well. London-listed investment trusts focused on private companies have tripled their assets in a decade to around £35bn.

What about retail investors and PE

Investing in private equity means locking money for long periods in illiquid products, i.e. difficult to sell, and with high fees. This has always made private equity a market sector not accessible to everyone.

In addition, it should be borne in mind that the conditions that favored high returns in the PE market were extremely low interest rates, which may soon disappear. Over the past 15 years, the private capital sector has grown rapidly to $8tn globally, of which 13 per cent is invested in western Europe. According to Morgan Stanley research, private equity delivered annualized total returns of about 13 per cent over the past 15 years, on a risk-adjusted basis, against about 8 per cent for the S&P 500.

So, is the private equity market really a convenient proposition for financial companies and banks that need solutions for retail investors?

The most important element to evaluate is the return on investment.

In private equity, standard fees include an annual management fee of 2% and a carry interest of 20% on the value of the exits obtained. It is necessary to ask whether a retail investor is able to understand these fees, comparing them with the potential financial returns of the asset class.

There are also regulatory issues that restrict access to the EP only to sophisticated investors.

Research this year by Bain, a management consultant, found that the top quartile of PE managers was far ahead of the public markets, with annualized returns above 20 per cent. However, the same research found that – after outpacing public markets for a decade – the performance of PE funds, net of fees, was the same last year as if the money had been put in the S&P 500.

The solution for individual investors

Based on the elements considered, one solution for individual investors could be an investment fund known as ‘semi-liquid’. This is a fund that limits the amount investors can withdraw in a given period. This is not an entirely new proposal, but has been popularized by Blackstone in the US.

Withdrawal limits are triggered if, in aggregate, investors attempt to withdraw more than a certain percentage of the fund’s total assets, typically 5% in a quarter. In such a case, a maximum of 5 per cent is withdrawn and divided among the investors who want cash.

Another possible alternative may be a very popular solution in the UK: “traditional” investment funds. These, structured as listed companies, can be used to hold private equity stakes. According to Peter von Lehe, CEO of Neuberger Berman, it is in the UK that the most successful democratization of private equity has taken place.

Most investment funds are not limited to sophisticated investors and have no minimum ticket size. Their great potential lies in solving the liquidity problem because their shares can be traded freely on the public market while the assets they hold remain permanent. Investment funds also allow managers to combine private equity with listed shares or other assets, such as property or infrastructure, in a single vehicle.

The disadvantage of investment funds lies in the separation between portfolio and share price; the latter can fluctuate with the general trend of the market.

Furthermore, typically the cost of administering investment funds is too high, this creates problems when, following a market crash, the fund units need to recover value. Excessive costs weigh on the recovery, generating below-average returns for the investors involved.

For investors with smaller portfolios, one solution may also be to invest directly in private equity transactions by pooling their resources. Several companies, e.g. Moonfare, offer this type of service. The only disadvantage is that these remain transactions that are more suited to sophisticated investors and thus difficult for individual investors to access.

For UK investors, the most traditional method of accessing this type of market tends to be venture capital.

An innovative and interesting proposal for the private equity market, and investors, may be the AMCs (Actively Managed Certificates). AMCs are structured financial products, more precisely Tracker Certificates, which replicate the performance of an underlying strategy, in this case the venture capital portfolio.

These tools combine the benefits of mutual funds with lower costs and faster set-up speed.

They can be listed or unlisted and can be used to make small investments on the order of 3/5 million pounds total, thus allowing even private investors easy access.

The flexibility of these tools also allows for single and targeted venture capital transactions, not just for a portfolio of private companies.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/