Unicorn: ‘’ privately held startup company with a value of over $1 billion’’.

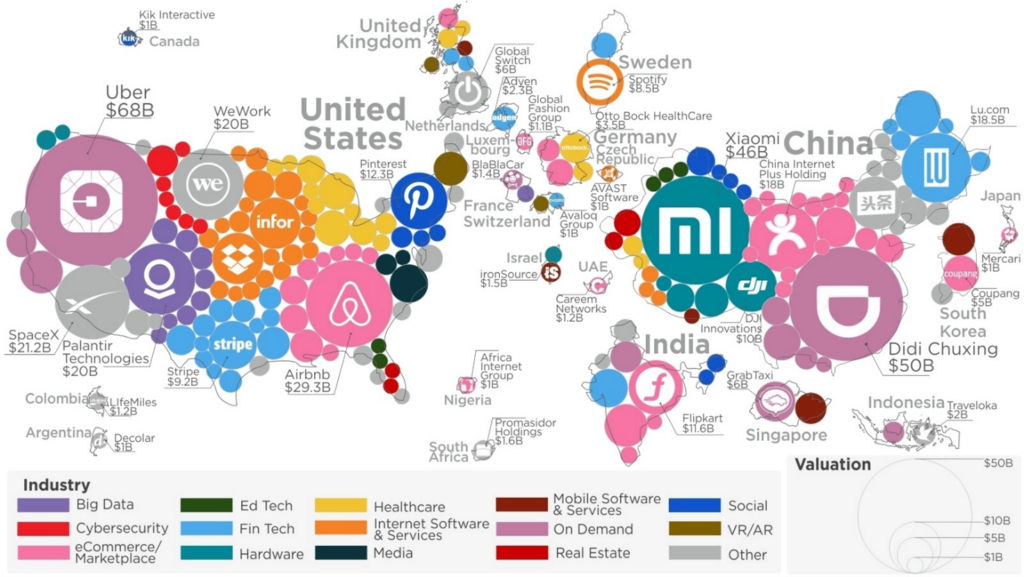

Unicorns are a regular feature in business and finance. There are more than 1,000 unicorns around the world, as of March 2022 and collectively they are valued at over $3,516 billion.

Some U.S.-based unicorns are Uber, Airbnb, SpaceX, Palantir Technologies, WeWork, and Pinterest. China claims several unicorns as well, including Didi Chuxing, Xiaomi, China Internet Plus Holding (Meituan Dianping), and Lu.com.

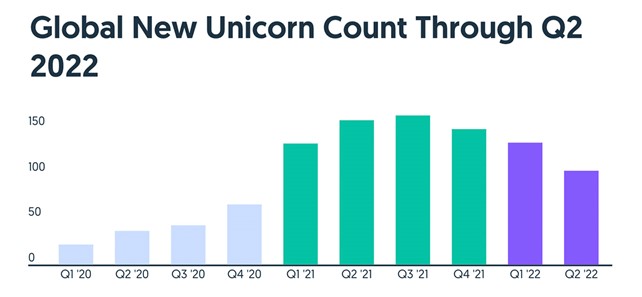

In 2021 the number of unicorns grew faster than ever, until reaching the number of 537 in that year. 2022 is meeting a huge drop of unicorn’s new births and expectations are even worse, indeed it’s estimated that by the end of the year only 27 unicorns will be born.

Near-zero interest rates and the adoption of digital technologies due to the Pandemic crisis are factors that led investors to gamble a huge capital into private markets so that unicorns’ valuations rose sharply during 2021.

2022 Trends, such as inflation, rising interest rates, and the war in Ukraine, led the macro environment to be unstable: big tech giants fell and emerging businesses turned down their plans to go public.

Furthermore, final-stage high-noticed start-ups’ valuation flowed down so that investors saw the value of their private portfolio markdown. 2022 unicorns’ decline might be attributed to investors’ uncertainty to have a return in venture capital funding since valuations are downwarding Public market volatility discouraged also many companies to go public through IPO or SPA.

While USA and ASIA are the two regions that suffered the most the economic slowdown for what concerned the birth of new unicorns, with respectively a percentage decrease of 5% and 20%. Europe experienced an unexpected increase of newly instituted unicorns, indeed, three out of ten main unicorns in Q2’22 are European. Five of the most valuable unicorn in that Continent are Klarna ($37,5B), Checkout.com ($35,4B), Revolut ($27,8B), Northvolt ($9,7B) and Global Switch ($9,6B).

This difference between unicorn new births trend in the US and Europe can be attributed to the fact that interest rates were increased earlier in the former. Additionally, investors like Tiger Global Management and SoftBank, which were the driving forces behind 2021’s heat wave, have historically paid much more attention to startups in the US and Asia than in Europe. For this reason, when they began to retreat this year Europe was left relatively unaffected.

Sectors that have seen the biggest decline in new unicorns are Fintech with an annual unicorns percentage decline of about 58%, and Retail tech, with 46%. In the meantime, Digital Health is the sector with the least annual decrease in fact it dropped only by 27%.

Therefore, public market volatility brought by the crisis has decreased investment funds and operations. Many investors have withdrawn funds from backing late-stage companies since they are more exposed to public market instability, for this reason, they have already shifted a vast portion of their private-market investing toward early-stage deals.

If there is not as much competition as it was before the recession, there will be less funding, making it more difficult for any given company to achieve a valuation higher than $1B.

In fact, the balance of power is shifting from founders to investors. Investors will be looking to understand which start-ups can achieve high valuations to efficiently direct their capital to more profitable companies. In this context, companies will need to demonstrate that they can balance sustainable growth and profitability to have a chance of reaching or maintaining the coveted $1 billion-plus valuation.

At the same time, unicorns will probably avoid raising new money if they can survive on current liquidity to avoid a bad round that would lower their valuations. Otherwise, they might seek alternative terms (e.g., debt capital than venture capital) that would limit the damage to their valuation.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/