Introduction

Historically, access to financial markets, investments, and wealth-building tools has been limited to a privileged few, leaving many individuals marginalized from the benefits of economic growth. However, recent decades have witnessed a transformative wave in the financial sector, characterized by the opening up of once-exclusive realms to the masses. With the advent of the Internet and the proliferation of fintech innovations, democratization has gained momentum, eroding barriers and providing individuals from diverse backgrounds with the means to participate in the global financial system. In other words, democratization in the financial industry entails the promise of increasing financial inclusivity, possibly leading to reducing wealth disparities, and empowering individuals and businesses to participate more actively in global markets.

In this article, we will delve into the multifaceted journey of democratization, exploring its key drivers, current trends, and the profound implications it holds for the future of finance and economic equality.

Historical developments

The democratization of finance did not emerge overnight; it is the result of a confluence of factors that have reshaped the financial landscape over the past few decades. One of the primary catalysts for change has been the internet. The digital age has facilitated unprecedented access to information, enabling individuals to educate themselves about financial markets, investment strategies, and personal finance management. Online brokerage platforms have democratized stock trading, allowing anyone with an internet connection to buy and sell securities, breaking free from the once-dominant grip of traditional brokerage firms.In parallel, the rise of fintech, short for financial technology, has ushered in a wave of innovative financial services. Peer-to-peer lending platforms connect borrowers and lenders directly, circumventing traditional banks. Robo-advisors use algorithms to provide low-cost portfolio management, making investing accessible to those with modest means. Crowdfunding platforms have redefined fundraising, enabling entrepreneurs and startups to tap into the collective resources of the crowd.

If you are curious about the specific role of any of these concepts, you can refer to our previous insights about fintech innovations.

Broadly speaking, fintech startups have increasingly revolutionized the approach to investing and financing businesses and corporations. By sparkling competition and offering a cost efficient alternative to traditional financial intermediaries and brokerage firms, they have contributed to making investments more accessible and to reducing investments and management fees.

Moreover, the increased global interconnection has made it easier for small businesses to have their project financed and has created an ecosystem in which capital can be moved more efficiently and more inclusively.

Global Financial Inclusion Index

How can we assess whether financial services are actually becoming more accessible? In other words, how inclusive is finance?

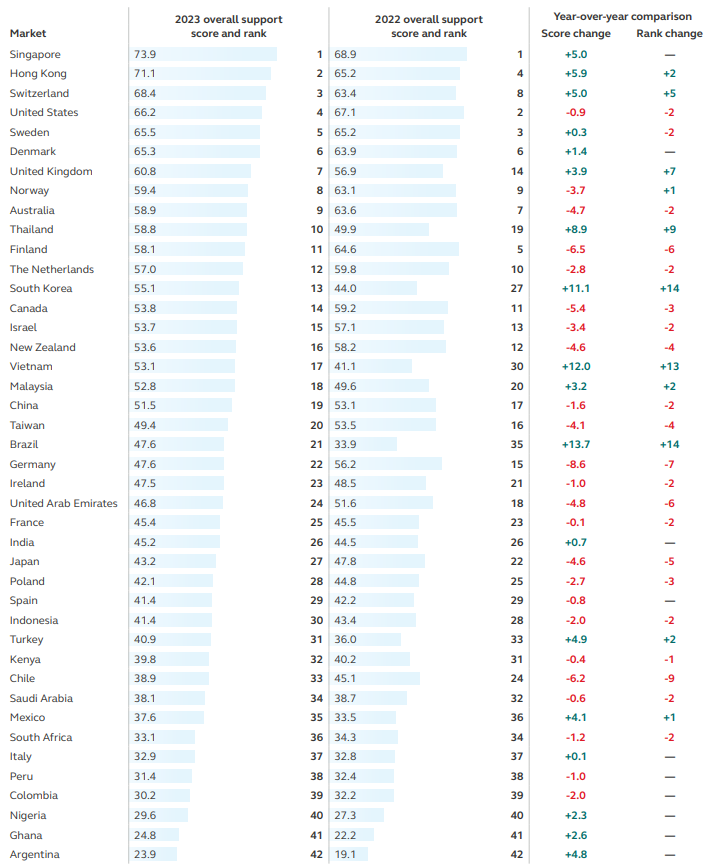

The answer to these questions can be found analyzing the Global Financial Inclusion Index Report, which quantifies the changes in financial inclusion across the 42 markets. This report allows historical comparability of data and facilitates the forecast of future trends.

Indeed, according to the World Bank, financial inclusion is defined as “individuals and businesses having access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit, and insurance—delivered in a responsible and sustainable way”.

In a nutshell, the 2023 report still underlines a strong disparity between financial inclusion in emerging countries and developed ones, with the only exception of Italy that ranks amongst the last countries with a score of 32.9 out of 100.

Still, the growth in emerging countries is much stronger than it is in more inclusive, developed countries, meaning that financial inclusion disparity is projected to decrease over time: “In last year’s report, we identified a number of categories into which the 42 markets analyzed can be divided. These categorizations provide an indication of some of the short-, medium-, and long-term risks to which economies are exposed. Broadly speaking, Europe’s largest, oldest economies fell into the category of mature, backward-looking economies, and Southeast Asian economies, by contrast, fell into the category of young, forward-looking economies. In this year’s data, we see a widening gulf between the two, with levels of financial inclusion in large developed markets stagnating or even deteriorating. Those that have built their financial systems from the ground up – with technology at their foundation – are now making leaps forward.”

Year-over-year change in scores and ranking by market across 2023 and 2022 iterations of the Global Financial Inclusion Index

Conclusion

In conclusion, the democratization of finance, driven by technological innovation and the proliferation of fintech solutions, represents a transformative force that is reshaping the financial landscape. It is breaking down the traditional barriers that have long excluded many individuals and businesses from the benefits of global financial markets. The Global Financial Inclusion Index Report serves as a critical tool for assessing the progress of financial inclusion, highlighting the persistence of disparities between emerging and developed economies and showcasing the role of technology in bridging this divide. The rise of digital financial services, peer-to-peer lending, robo-advisors, and crowdfunding has made investing and access to capital more accessible and cost-effective than ever before. This financial democratization offers the promise of greater inclusivity and reduced wealth inequalities, hopefully prefiguring a more equitable and interconnected financial future.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/