Introduction

In the realm of green finance, recent developments and research shed light on key areas of focus, challenges, and potential solutions. From regulatory actions to market trends and quality concerns, the landscape of sustainable finance is evolving rapidly. This overview delves into three significant insights: the implementation of fair competition rules for external reviewers of EU green bonds by ESMA, the dominance of railway investments in sovereign green bond allocations, and the examination of sustainability-linked bonds within the climate bond market.

ESMA Implements Fair Competition Rules for External Reviewers of EU Green Bonds

The European Union’s securities supervisor, the European Securities and Markets Authority (ESMA), has recently set down rules that should guarantee fair contest on the part of the external reviewers of green bonds.

However, these regulations are meant to sustain cost-effective deals for issuers while green bonds serve as a pathway towards a carbon-free economy for the EU by 2050.

In October last year, some voluntary principles adopted by the EU for the issuers of green bonds seek to close the credibility gap, in order to ensure that the funds indeed go to projects that abide by the EU environmental standards, as stipulated by the EU “taxonomy”.

With its latest step, regulators followed the EU Green Bond Regulation that was complemented by a public consultation opened on March 26, 2024. The present paper is the first, from a set of two consultations, by ESMA, and the next one, has been scheduled to take place in Q1 2025. The regulation defines detailed parameters and conditions for the bonds that will hold either the ‘European Green Bonds’ or ‘EuctB’ designation.

It establishes a registration system and supervisory framework for external reviewers of these bonds, aiming to prevent greenwashing within the market. Moreover, the regulation includes voluntary disclosure requirements for other environmentally sustainable bonds and sustainability-linked bonds issued in the EU. In the consultation paper, ESMA outlines four draft regulatory technical standards and one draft implementing technical standards concerning the registration and supervision of entities aspiring to become external reviewers of EU green bonds. These standards aim to elucidate the criteria for evaluating registration applications, covering aspects such as the qualifications of senior management, board members, analytical resources, management of conflicts of interest, analyst expertise, and outsourcing of assessment activities, along with standardizing forms, templates, and procedures for registration information provision, as mandated by the EU Green Bond Regulation.

Railway Investments Drive Sovereign Green Bond Allocations

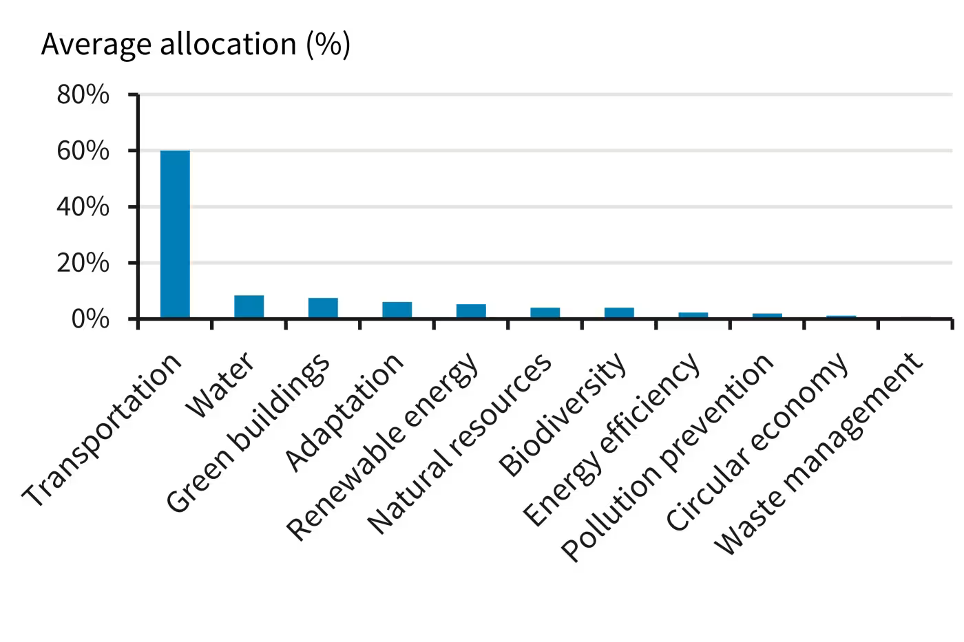

Sovereign green bonds have become a popular means for countries to raise funds, surpassing $500 billion in total. You might think that the funds raised by these green bonds are mainly allocated to supporting renewable energy or efficient energy projects, but in reality it has been seen that a large portion of these funds has been allocated to projects to improve railway infrastructure, in particular, this happened in: UK, Belgium, Chile, Spain, Denmark and Israel.

Environmental bonds typically trade at a small premium against regular government debts, but thorough adherence to auditing requirements permits the financing to be not much cheaper in terms of cost. However, a stronger financial case is still not present and the attraction of green sovereign bonds seems to come from attractive labels more than the substantial benefits.

One reason for the coordination of funds for railway projects could be that the resulting benefits are easily tangible, i.e.: reduction of air pollution, reduction in road accidents and congestion. Though green projects are a priority yet, it seems that there is no management and it is also uncertain what constitutes ‘green’ in sovereign green bonds. Due to the absence of a regulatory framework, different organizations are given the room to choose what projects to fund, which makes it a possibility for greenwashing and financing projects that cannot work towards the environmental objectives.

Apart from this, the issues of accountability and transparency in the case of sovereign green bonds arise as well. Only half of the bonds have provisions to revoke their green label if the financed projects fail to meet eligibility requirements. Additionally, there’s a risk of funds being used to refinance existing projects rather than funding new initiatives.

However, Europe, as seen previously, is implementing new regulations to avoid this, implementing control requirements, such as annual impact reports.

Challenges in the Climate Bond Market: Examining Sustainability-Linked Bonds

The climate bond market, valued at $280 billion, aimed to incentivize issuers to achieve green targets, but new research from Bloomberg suggests it’s largely falling short. According to the Climate Bonds Initiative (CBI), over 80% of sustainability-linked bonds (SLBs) issued between 2018 and November 2023 fail to align with global climate objectives. These bonds, while similar to regular bonds, carry incentives for issuers to meet sustainability goals, typically resulting in interest rate adjustments.

One reason SLBs are attractive to issuers is their flexibility; unlike green bonds, proceeds can be used for general purposes rather than specific projects. This accessibility extends to heavy polluters like cement and steel manufacturers. The market saw its beginnings in China in December 2018, with European corporations and, more recently, sovereign entities such as Chile and Uruguay, joining in.

While issuance peaked at $110 billion in 2021, cooling investor demand followed criticism of unambitious goals and weak penalties, often associated with greenwashing. CBI’s assessment reveals that only 14% of SLBs meet the Paris Agreement’s climate targets, indicating a significant quality issue in the market. Weaknesses in design and execution, including poor reporting and insufficient decarbonization plans, contribute to this problem.

CBI highlights loopholes in SLB documentation, such as exemption clauses for missed targets due to policy changes and the exclusion of certain acquisitions from performance evaluations, which undermine deal credibility. Despite these challenges, there’s room for improvement.

Conclusion

Overall, these insights underscore the complex dynamics within the realm of green finance. While regulatory efforts like ESMA’s rules for external reviewers of EU green bonds aim to enhance transparency and integrity, challenges persist in ensuring funds are effectively allocated toward sustainable projects. The prevalence of railway investments in sovereign green bond allocations highlights the need for clearer definitions and stricter oversight to align financing with environmental objectives. Similarly, the shortcomings identified in sustainability-linked bonds within the climate bond market emphasize the importance of robust standards and accountability mechanisms to drive meaningful progress toward global climate goals.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/