Abstract

Artificial Intelligence needs no introduction. It is the latest and most advanced technological tool, one that poses questions and raises concerns about the future evolution of the job market, the potential need for a universal basic income, and its profound impact on how we think, study, and live. Regardless of how predominant AI will be in the future, what is undoubtedly evident is that AI is increasingly becoming a “world changer technology”.

The aim of this research is to analyze the impact of the evolving artificial intelligence industry on financial markets, assess how its development can influence world economies, and specifically delve into the structural dynamics within the industry, comparing the roles and impacts of startups versus established incumbents. Said alternatively, our focus is on analyzing artificial intelligence from an economic and financial perspective. We aim to conduct comparative and technical analyses to understand how AI’s development might influence global economies and financial markets. We will explore the parallels and distinctions between AI and other transformative technological eras, to try and make forecasts about the future financial development of this potentially disruptive technology.

A Comprehensive Exploration of AI Industry Growth: will private and public investment stimulate a responsible use of AI technology?

Before making forecasts about future trends, we need to analyze how the current landscape of artificial intelligence is influencing various industries and sectors. Indeed, the impact of AI is evident across diverse domains, from healthcare to finance, manufacturing to entertainment. By dissecting the existing state of AI adoption, we can discern patterns and trends that offer valuable insights into the potential trajectory of future developments.

In the realm of healthcare, for instance, AI is revolutionizing diagnostics, drug discovery, and personalized medicine. Financial institutions are leveraging AI for risk assessment, fraud detection, and algorithmic trading. In manufacturing, AI-powered automation is enhancing efficiency and precision, driving advancements in smart factories and supply chain optimization. The entertainment industry is witnessing the integration of AI in content recommendation algorithms, virtual reality experiences, and even in the creation of music and art.

However, the examples above are just the tip of the iceberg and, as noted by Goldman Sachs, “AI investment is expected to be concentrated in four key business segments: companies that train and develop AI models, those that supply the infrastructure (for example, data centers) to run AI applications, companies that develop software to run AI-enabled applications, and enterprise end-users that pay for those software and cloud infrastructure services”. The widespread adoption of AI models clearly facilitates the growth of the sector and attracts public and private capital. This growth will likely be reflected by a substantial increase in investments, with the share of U.S GDP devoted to AI related investments expected to rise from 1.5% to around 4%. The sector’s sensitivity to market movements underlines a positive correlation between the market and AI-related stocks. Assuming that past performance is somewhat reflective of future trends, we note how AI stocks exhibit a beta (a measure of market risk) that is larger than one. This means that, on average, a 1% change in the market portfolio leads to more than 1% change in the AI stock. For instance, financial indexes such as The Nasdaq Global Artificial Intelligence and Big Data Index, designed to track the performance of companies engaged in Deep Learning, NLP, Image Recognition, Speech Recognition & Chatbots, Cloud Computing, Cybersecurity and Big Data, underscore how AI and Big Data related companies have been outperforming the broad market, represented in our example by the Nasdaq Composite. Similarly, when the market performs poorly, AI stocks do worse.

Overall, the market evolution has been the result of heightened efficiency and improved quality in the implementation of AI applications. As noted by Our World in Data, “just 10 years ago, no machine could reliably provide language or image recognition at a human level. However, AI systems have become much more capable and are now beating humans in these domains”.

The increased reliability of AI tools has served as a catalyst for heightened interest and trust among businesses, leading to a more widespread integration of artificial intelligence in various corporate contexts. As AI technologies become more dependable, organizations are more inclined to leverage these tools to streamline processes, enhance decision-making, and drive innovation. The positive feedback loop of increased reliability leading to greater adoption is likely to propel further advancements in AI technologies, creating a positive trajectory for the continued integration of artificial intelligence in corporate environments.

Data supports this trend as analysts underline that the AI industry will likely reach a global market size of US $200 billion by 2025, a number which is set to increase tenfold by 2030, according to Statista.

From the financial perspective, the AI industry appears to be a preferred choice amongst investors that see Artificial intelligence as a “world changer technology” with the same disruptive power of the Internet. In this regard, private equity and venture capital firms have been increasingly more operative in the industry and have been financing more and more AI related startups, despite sub-optimal economic and market conditions.

Moreover, many have suggested how artificial intelligence could revolutionize the scientific approach. AI tools have turned out to be useful in the medical and biological fields. The Organization for Economic Cooperation and Development (OECD) has published a study (OECD 2023, Artificial Intelligence in Science: Challenges, Opportunities and the Future of Research, OECD Publishing, Paris) that underscores how the correct application of AI features in the scientific landscape could contribute to raising living standards, producing scientific knowledge that is urgently needed, and overcoming hurdles in areas of science that are becoming more difficult to tackle.

We note that investments in this realm will likely attract public capital from States and public entities, aiming at promoting the development of Startups and fostering the research and development of innovative technologies, or novel scientific applications. For instance, Italy has set aside a considerable amount of the €235 billion of the National Recovery and Resilience Plan (PNRR) to enhance the country’s competitiveness in the field of digital technologies. To be more specific, researchers from The Scuola Normale Superiore in Pisa will work to develop artificial intelligences centered around humans to guide their learning and reasoning for synergistic interaction, understanding, and governance of socio-technological systems, social media, and online markets. The University of Trento will address complexity by studying and researching interdisciplinary and integrated approaches. The University of Naples will work on resilient algorithms against potential external attacks. The Polytechnic University of Milan will study the adaptability of AI-based technologies. Sapienza University of Rome will apply artificial intelligence to industrial processes, the safety of autonomous vehicles, power plants, scientific experiments, and data management in public administration. The University of Bari will focus on symbiotic artificial intelligence to enhance human-machine collaboration. The Polytechnic University of Turin will design and develop new algorithms capable of processing large-scale data with new computing paradigms. The University of Bologna will address the pervasiveness of artificial intelligences, creating intelligent models integrated into sociotechnical systems, holistically approaching various aspects of their integration, from individual behaviors to technology potential, from the educational value of new technologies to scientific and ethical implications. The University of Calabria will concentrate on Green-Aware AI, promoting, developing, and adopting artificial intelligences based on green values of respecting and preserving the planet. The Italian Institute of Technology in Catania will deal with integrated AI in learning, imitation, and the realization of systems capable of replicating cognitive, behavioral, and social mechanisms of biological matrix. (AboutPharma)

We must also recognize, however, that the misuse or the abuse of artificial intelligence tools can be extremely dangerous and can backfire, leading to catastrophic consequences for the whole society. It is crucial, hence, that international organizations and States make sure that the application of AI technology is for the betterment of society.

In this context, it is vital to underscore the fundamental need to address the challenges posed by the development of Artificial Intelligence technologies, which are advancing at a pace that surpasses current efforts to bring these tools under effective supervision. This supervision may be granted by the U.K. that has manifested the intention of becoming an international hub in matters of technology and blockchain. Indeed, to evaluate social risks and national safety concerns, many high tech and AI companies, such as OpenAI, Google DeepMind, Amazon, Microsoft, and Meta, have voluntarily signed a memorandum that grants the British government the ability of overseeing the development and deployment of AI technologies and how they affect societies. Many have already warned about how AI implementation could revolutionize the job market and others have already clarified their viewpoint according to which, in the future, a universal basic income will be necessary to provide financial support for those whose jobs are displaced by artificial intelligence. In this context, making forecasts about the long-term development of the market is extremely difficult as it can turn out to be highly influenced by unforeseen events or regulatory changes: the potential for negative uses of AI, such as unethical practices, security breaches, or misuse of personal data, poses significant risks to the reputation and stability of companies operating in the AI space. From a financial perspective, any negative use of this double-edged tool can hinder the growth of the market and can negatively affect the performance and valuation of all those public or private companies that operate in the creation and development of AI softwares and applications.

Considerations on the Future Economic Development of Artificial Intelligence

In the opening section of the paper, we noted how Private Equity and Venture Capital firms have taken an important stance in 2023 by directing substantial capital towards AI related startups and unlisted private companies. This piece of data seems to contradict the evidence of 2022: “as with the global VC market, overall VC investments in AI firms experienced a significant drop of over 40%. This reflects broader VC trends, with investors exercising more caution after the tech boom of the COVID-19 pandemic years, rising interest rates, and inflationary pressures. An exception to the cooling trend in VC investments is generative AI, which some analysts estimate has increased in VC investments by nearly 500% in just 2 years (from USD 230 million in 2020 to USD 1.37 billion in 2022) (Temkin,2022[121]”).

(OECD, AI language models: Technological, socio-economic and policy considerations).

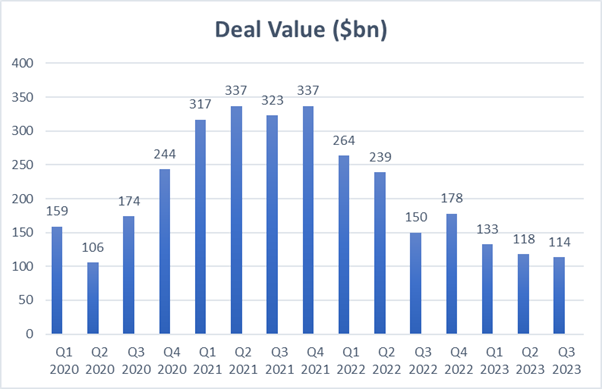

This paradox is easily resolved if we consider that private equity and venture capital investments are slowing down across advanced economies because of unfavorable market conditions. Said alternatively, AI related startups enjoy a bigger piece of a smaller pie. As evidence, we refer to data published by the S&P Global in The Private Equity and Venture Capital Deal Landscape: Q3 2023

Now, the market scenario remains uncertain and, despite the slowing down of inflation in major economies such as the U.S and the Euro Area, central banks are set to confirm the current high interest rates at least for the beginning of 2024.

The tight credit conditions are notably unfavorable for startups, as securing funds comes at a higher cost and, hence, at a higher risk. This risk is even further exacerbated in IT and artificial intelligence companies, one of the most volatile industries. Consequently, the growth of AI related startups can be hindered and slowed down until the global macroeconomic outlook eases. Potentially, and at least theoretically, the increased difficulties in accessing finance pose a significant barrier to entry for startups and potential entrants in the market, contributing to keeping a substantially lower level of competition in the industry. Evidently, the low competition can have a negative effect on the innovation of the industry, which, however, remains very fast.

Economic theory is conflicting on the topic:

- When choosing to invest in technological progress, all firms face a problem of technological uncertainty, meaning that innovation or development are risky and uncertain, and all competitive firms might also face a problem of strategic uncertainty. Firms possessing some market power may be able to use more internal funds to support their innovative activity than firms in a perfectly competitive environment. This is a noticeable advantage, since external financing for R&D is available at a higher cost because of the risk involved in innovative activity, and because it may require the dissemination of intermediate research results to financially supporting firms or institutions. (Schumpeter, “Capitalism, Socialism, and Democracy”)

- On the contrary, Arrow theorizes the replacement effect, the idea that firms already holding market power lack incentives to invest in R&D because gains from innovation will only replace current gains. Moreover, specifically to the segment of disruptive technology, we note that big incumbent firms face the so-called Innovator’s dilemma, a concept coined by Harvard professor Clayton Christensen. The concept highlights the inherent challenge for successful, established companies in adapting to and adopting innovations that may initially seem inconsequential or unappealing to their existing customer base. The dilemma arises from the tension between sustaining innovation, where companies focus on refining and optimizing existing products and services, and disruptive innovation, which introduces entirely new and usually more efficient solutions. Large companies, often built on successful business models, may find it difficult to shift their focus away from what has traditionally brought them success. Moreover, the Innovator’s Dilemma suggests that these established firms, due to their size, structure, and existing customer feedback mechanisms, may be inherently resistant to disruptive change.

Still, the immense growth of the generative AI sector and the fact that, despite the challenging economic outlook, main capital providers around the world finance AI and machine learning related startups opens two plausible, but very different scenarios:

- Scenario 1: The widespread introduction of AI models across different sectors and industries enhances societal and economic efficiency.

In this context, the sector would be poised for accelerated growth and the blooming of generative AI would mark the beginning of a series of novel technological introductions that would contribute to creating a hyper-efficient society. The technocratic use of AI technology would foster innovation and optimization. Investors’ bullish position would be justified by the widespread adoption and development of AI models in virtually every sector and industry.

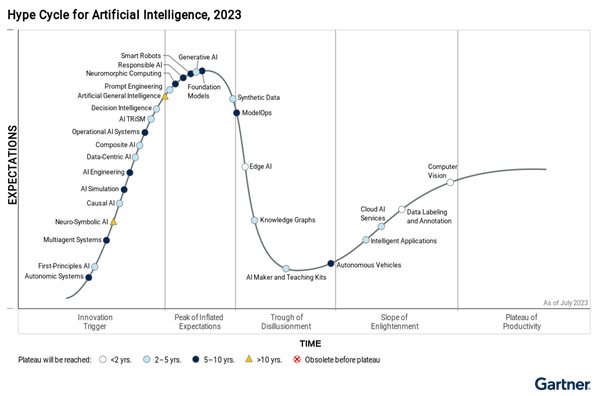

- Scenario 2: AI, and more specifically generative AI, is at the peak of the Gartner Hype Cycle

This scenario implies that investors’ decisions are driven by hype rather than a factual and accurate valuation of the sectors’ performance and expectations. The example of generative AI represents the peak of inflated expectations as, according to Gartner, “Generative AI is dominating discussions on AI and has reached the Peak of Inflated Expectations, together with foundation models, which have become bigger and exhibit behaviors that display human-level performance on a variety of complex comprehension tasks. The hype surrounding these models, often in news and media, generally focuses on cherry-picked examples of output rather than a realistic assessment of their strengths and weaknesses. There is still a large gap between the expected potential impact and actual usage.”

In this scenario, the creation of artificial intelligence technologies can be assimilated to the introduction of the Internet in 1998, when investment decisions and market sentiment were driven by a generalized sense of hype, rather than a careful valuation of Internet-related innovations.

An alternative perspective suggests that the growth of generative AI companies can be explained in terms of efficiency. As the macroeconomic environment was worsening in 2022, the tech sector began correcting and recalibrating considering higher inflation and higher interest rates.

“The massive correction has seen a rebalancing of investment and financing strategies from “grow at all costs” to “maximize efficiency”. This shift is great for AI as the technology sector is a logical first adopter and the tech sector’s recent focus on efficiency makes AI experimentation and adoption a C-Suite priority. While many startups are leaning away from the tech sector as a target market, hoping that other sectors like hospitality, energy, health care, and finance have fewer budgetary headwinds, AI startups should lean into the sector as an ideal early adopter” (Mark Roberge, Startups Versus Incumbents: Who Will Win the Go-to-Market AI Race?).

Conclusion

What emerges is that there are contrasting forces acting in the market that contribute to creating a very uncertain scenario for the development of AI companies. This remarkable uncertainty is the evident result of ambiguous valuations and is clearly, at least partly, driven by a general positive investor sentiment towards the sector.

On the one hand, there are indications of robust growth and increased investments in certain segments of the AI industry. However, this positive momentum appears to be counterbalanced by broader market conditions and a difficult and unpredictable short-term economic outlook. The ambiguity in valuations suggests a market that is grappling with the challenge of accurately assessing the worth of AI companies. This challenge may arise from various factors, including the rapidly evolving nature of AI technologies, uncertainties in regulatory landscapes, the varying degrees of market readiness for different AI applications, and the possible misevaluation of such applications. Crucially, the positive investor sentiment toward the sector seems to be both a driving force and a complicating factor. While it can fuel enthusiasm and support for AI companies, it may also contribute to inflated expectations and valuations, akin to the situation during the dot-com bubble in the late 1990s.

Moreover, it is difficult to clearly establish a pattern between the position of incumbents and AI startups within the market. Again, this is because the market conditions appear to be suboptimal to stimulate the movement of capital towards startups. However, the same AI startups are likely more innovative and potentially more profitable than incumbents, as the latter realistically are not ready to modify their business structure and adopt disruptive technologies that eventually would modify the nature and the model of their businesses.

Appendix

APPENDIX 1

Data for the Nasdaq Global Artificial Intelligence and Big Data that are reported on Nasdaq.com. You can access the data by clicking this link. Data for the Nasdaq Composite are extracted from Nasdaq.com. You can access the data by clicking this link.

The graph plots the Nasdaq Global Artificial Intelligence Index (black line) against the broad market index, represented by the Nasdaq Composite (blue line) from 06/12/2022 and 06/12/2023. Both indexes are indexed at 100, meaning that that their initial values are standardized for comparison purposes. This normalization allows for a clear representation of the two indexes facilitating a comprehensive analysis of their respective movements over the specified period.

APPENDIX 2

As noted in Our World in Data, “the chart relies on data published by Kiela et al. in Dynabench: Rethinking Benchmarking in NLP (2021). It shows the speed at which these AI technologies developed increased over time. Systems for which development was started early – handwriting and speech recognition – took more than a decade to approach human-level performance, while more recent AI developments led to systems that overtook humans in only a few years. However, one should not overstate this point. To some extent, this is dependent on when the researchers started to compare machine and human performance. One could have started evaluating the system for language understanding much earlier, and its development would appear much slower in this presentation of the data.

To better understand the chart, the reader should notice that the initial capability of each AI system is normalized to an arbitrary value of -100 and it is benchmarked to human performance, which is set to 0. To know more about the methodology, please refer to the above-mentioned paper (Kiela et al. in Dynabench: Rethinking Benchmarking in NLP (2021)).

References

BIBLIOGRAPHY

- Deloitte, “The Socio-Economic Impact of AI in healthcare”

- Italian Government, “Strategic Program on Artificial Intelligence 2022-2024”

- NASDAQ, “A deep dive into the Nasdaq Yewno Global Artificial Intelligence and Big Data Index“

- NASDAQ, “Global Artificial Intelligence and Big Data Index”, Index Methodology

- Kiela et al. in Dynabench: Rethinking Benchmarking in NLP (2021).

- OECD AI Policy Observatory, “OECD, AI language models: Technological, socio-economic and policy considerations”

- OECD (2023), Artificial Intelligence in Science: Challenges, Opportunities and the Future of Research, OECD Publishing, Paris

WEBLIOGRAPHY

- AboutPharma

- Nasdaq.com, “Global Artificial Intelligence and Big Data Index”

- Gartner, “Hype Cycle for Artificial Intelligence, 2023”

- Goldman Sachs, “AI investment forecast to approach $200 billion globally by 2025”

- Mark Roberge, “Startups Versus Incumbents: Who Will Win the Go-to-Market AI Race?”

- Gartner, “Hype Cycle for Artificial Intelligence, 2023”

- Our World in Data, “Artificial Intelligence”