Over the past decade, private equity firms have outperformed traditional asset classes like stocks and bonds, posting impressive returns and attracting increasing amounts of capital from institutional and individual investors alike. However, as we saw in 2022, the private equity market is not immune to the broader economic forces that can impact all investment classes.

Private Equity’s Record-Breaking Performance in 2021 Extends into 2022

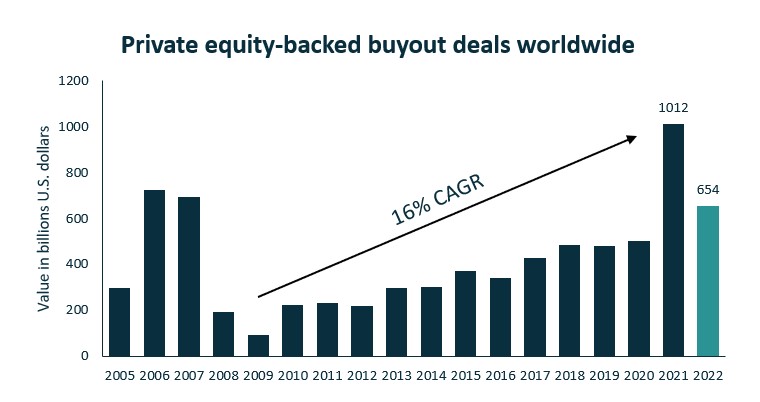

Private equity had an impressive run in 2022, managing to achieve its second-best year ever despite the challenges posed by persistent inflation, geopolitical tensions, and rising interest rates. However, the second half of the year saw a sharp decline in deals, exits, and fundraising, signaling a turn in the cycle. According to industry data, private equity-backed buyout deals worldwide grew at a compound annual growth rate (CAGR) of 16% after the financial crisis of 2009 to 2022, with a significant spike in 2021. This momentum continued in the first half of 2022, with the industry extending 2021’s record-shattering burst of deal activity.

Private Equity Adapts to Changing Market Landscape in 2022

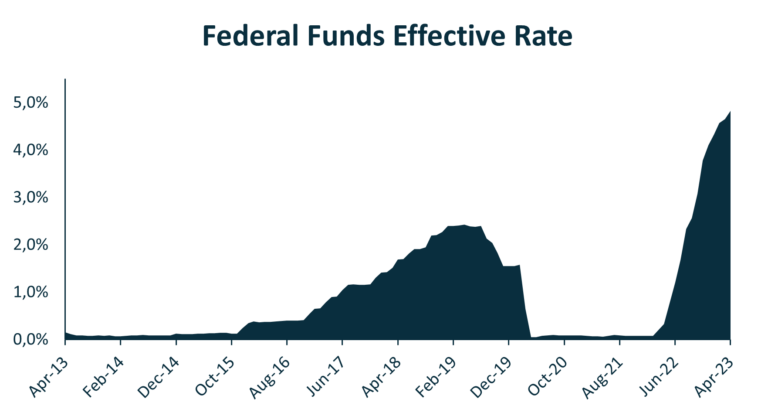

Despite the industry’s impressive performance in 2022, the private equity market experienced a sharp slowdown in the second half of the year. In June, the US central bankers issued the first in a series of three-quarter-point interest rate hikes, which led to banks pulling back from funding leveraged transactions. The rise in interest rates has already shut off the spigot of cheap, obtainable debt financing, which has been a crucial factor in fueling private equity deal-making in recent years. This sudden tightening of credit caused deal-making activity to fall off a cliff, pulling exit and fund-raising totals down with it. The impact of this unprecedented mix of macro forces cannot be denied.

As a result of these changes, private equity firms are facing a new reality. Moreover, the deep ambiguity about the future course of global economic activity is likely to cast a shadow over the private equity value chain through 2023’s first half, if not beyond.

Despite these challenges, private equity firms are adapting to the changing market landscape. Some are exploring alternative financing options, such as direct lending and mezzanine debt, to fund deals and generate returns. Others are pursuing more selective and strategic investment opportunities, focusing on sectors and geographies that are likely to experience continued growth in the years ahead. While the outlook for 2023 remains uncertain, private equity firms are expected to continue finding new ways to generate returns and navigate the evolving market conditions.

In conclusion, the private equity industry experienced a slowdown in 2022, but there are reasons to be cautiously optimistic about the outlook for 2023. While the challenges posed by rising interest rates and economic uncertainty cannot be ignored, private equity firms are expected to adapt and find new ways to generate returns. As always, success in private equity will depend on the ability to identify and capitalize on the right opportunities in a rapidly changing market.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/