Together with…

Introduction

Within the ever-evolving financial landscape, Collateralized Loan Obligations (CLOs) stand out as dynamic instruments meticulously overseen with acute precision. Central to this intricate ecosystem is the CLO Manager, entrusted with the complex task of crafting diversified portfolios of corporate loans.

Comprising market dynamics, investor involvement through various tranches, and robust risk mitigation strategies, this overview delves into the essential components of CLO management.

CLOs management: portfolio and figures involved

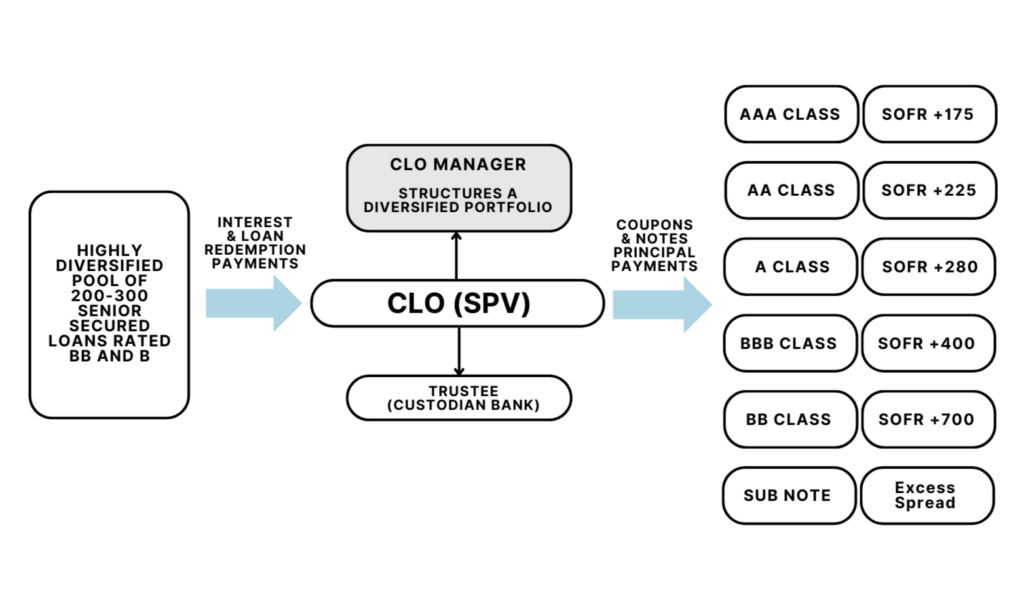

In the realm of Collateralized Loan Obligations (CLOs), various stakeholders play integral roles in steering the course of these complex financial instruments. At the forefront of this intricate ecosystem stands the CLO Manager. Charged with the pivotal task of selecting and managing a diverse portfolio of corporate loans, the CLO Manager oversees a multitude of CLOs portfolios, but each is a separated legal entity. Typically each portfolio comprises between 200 to 300 different loans, where the average loan position is around 0.5% of the portfolio and the largest loan represent around 1% of the sum of all the loans .

In a typical investment in a fund, investors receive (un-rated) shares which all have equal economic rights and represent a percentage of the portfolio. The Asset Manager will use the investors’ money to purchase different assets whose under or over performance is equally shared among all investors.

Investors in a CLO de facto buy a diversified pool of loans, but they chose one or more bonds, so called “tranches”, that have different ratings. They differ from the shares of a traditional fund because they have different economics in terms of priority of payments for the quarterly interests and principal distributed by the loans in the CLO portfolio. The tranches/bonds that have priority of payment receive a AAA official rating, the following tranche is rated AA because is paid after the AAA. In a CLO there are usually 6 tranches, from AAA to BB and a non rated tranche also called subordinated or equity note. The latter receive high quarterly distribution (excess spread) which is calculated as the difference between the interests earned on the loan portfolio including the related trading activity performed by the CLO manager, after all interest are paid to all the other tranches. As the weighted average interest paid to the rated tranches is well below the average interest collected on the loans, an Excess profit is generated and paid to the Subordinated tranche.

Holders of lower and not rated tranches face the risk of not receiving all the interests and/or the full capital invested if the default rates of the loans portfolio increase. It takes a very high and continuous level of default for a Subornidated tranche not to be repaid fully.

Ratings are assigned by at least two of the three major rating agencies: Moody’s, S&P, and Fitch. These agencies sets a number of parameters that the CLO managers has to adhere to in order to maintain the rating of the different tranches. The CLO Managers during the first years will reinvest any prepaid loans. After the end of the reinvestment period, tipically 4 or 5 years, the proceeds from loan repayments are used to pay the principals of the rated tranches starting with the AAA one. As this happens often the other tranches are upgraded as their overcollateralization increases.

One of the benefits of CLOs is the opportunity to invest in a well-diversified portfolio of loans collateralisd (secured debt) and to be an actively managed instrument. Managers have the task of buying and selling individual secured loans (organized and distributed by banks) within the underlying collateral pool to generate gains and reduce potential losses. The loans in the CLO portfolio are issued by large companies such as Dell Computer, Burger King, McAfee, Virgin Media, American Airlines, Hilton Hotel, and Uber.

The role of the CLO Manager is typically fulfilled by credit asset managers of prominence, such as Blackstone, Prudential, Allianz Global Investors, KKR, Neuberger, ARES, and Apollo. As mentioned earlier, their role is akin to that of a manager of a traditional active fund: selecting the portfolio and actively modifying its composition during the CLO’s lifespan.

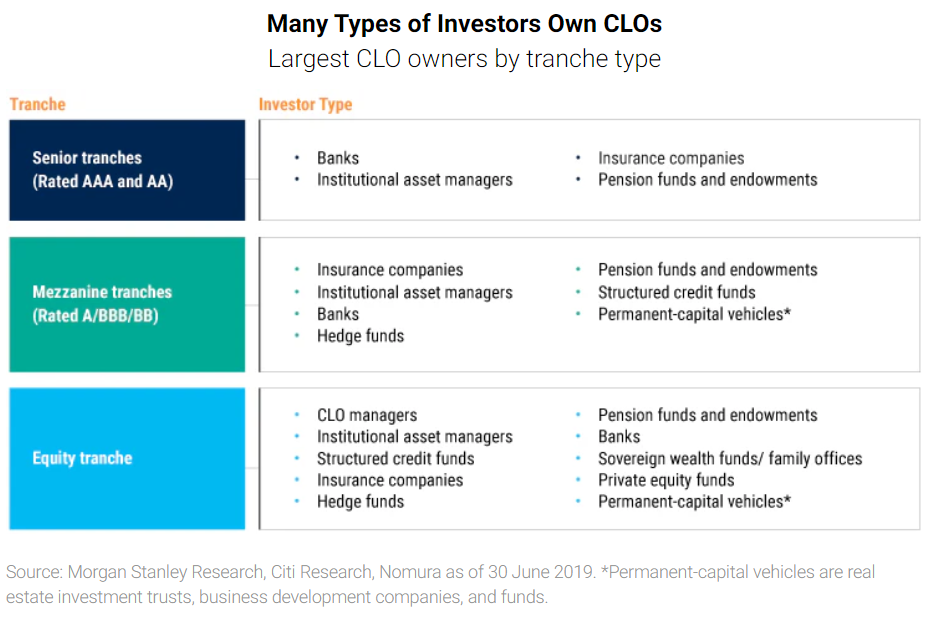

As for the types of investors holding CLOs, they vary based on ratings. Higher rated CLO tranches are usually acquired by money market funds or by insurance companies and banks that are penalized in terms of regulatory capital requirements when investing in unrated or lower rated assets. On the other hand, the lower tranches attract a broader range of investors such as specialized credit funds, family offices, sovereign wealth funds and even ultra high networth individuals that diversify in this asset class as a safer and higher yielding than traditional bonds.

CLOs provide effective portfolio diversification and, consequently, serve as a solid risk mitigation tool.

Firstly, we have Collateral Concentration Limits. Generally, it’s mandated that 90% of the portfolio is directed towards senior secured loans. This ensures a significant focus on more secure loan types.

Then, there’s the concept of Borrower Diversification, the pool of loans must be well-diversified, spread across 200-300 distinct obligors spanning 20-30 different industries. And only a small percentage of assets can be above 1% .

Finally, let us address the Borrower Size Requirements. These rules are regulatory safeguards, effectively inhibiting CLO fund managers from acquiring loans issued by smaller enterprises characterized by low market liquidity and higher risk. This mechanism serves as a method to circumvent potential risks linked to less substantial entities within the market. Geographic exposure is as well addressed, limiting or prohibiting the exposure to companies based in countries with weaker or inefficient bankruptcies or restructurings frameworks.

In summary, all these measures together contribute to strengthening the CLO structure, diminishing risks, and ensuring a well-proportioned, diversified, and robust financial framework.

Conclusion

The world of Collateralized Loan Obligations (CLOs) unfolds as a dynamically managed and strategically navigated domain within the broader financial landscape. Guided by meticulous CLO Managers, these instruments create diversified portfolios amidst market intricacies.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/