Numerai is a decentralized hedge fund that leverages artificial intelligence and thousands of machine learning algorithms to make informed investment decisions in the stock market. Founded in 2015 by Richard Craib, a South African mathematician and former hedge fund analyst. The platform’s goal is to revolutionize the way investments are made by combining the command of machine learning with the collaborative power of crowdsourcing.

Numerai’s business model is unique because it empowers individuals from around the world to participate in the investment process by contributing their own trading algorithms to the platform.

This inclusive approach challenges the traditional process of investing, where only a select few have the authority to make investment decisions on behalf of a fund like that run by Numerai. By tapping into the collective expertise of data scientists and machine learning experts, Numerai levels the playing field and fosters a collaborative community that values open contribution and collective knowledge sharing with the goal of generating returns.

This has helped drive innovation and improve the accuracy of predictive models, positioning Numerai as a trailblazer in the alternative investment industry. As a result, Numerai is paving the way for a more decentralized, collaborative, and data-driven future in the world of investing.

Giving away financial data

Despite purchasing high-quality financial data from various providers, Numerai is limited by license restrictions that prevent it from freely sharing this information with participants. However, the company has ingeniously sidestepped this issue by encrypting the data in a way that makes it impossible for anyone to know what the stocks or investments are.

By transforming the investment problem into a complex mathematical puzzle, Numerai has created a system where participants can create machine learning models that predict the performance of different stocks without any prior knowledge of what they actually represent. This approach has allowed Numerai to democratize access to high-quality financial data, empowering anyone with machine learning expertise to contribute to the investment process.

NMR & Staking

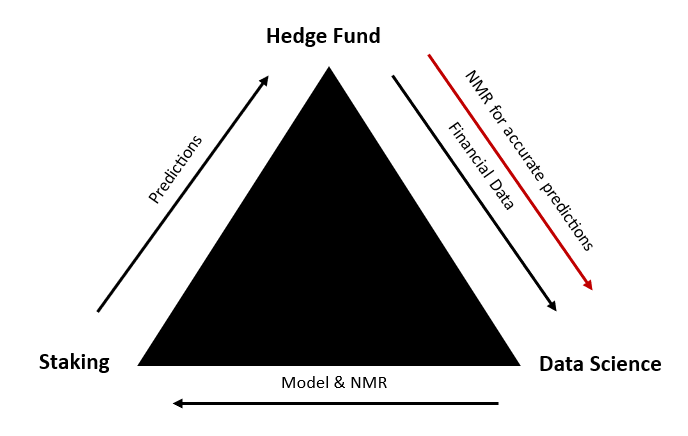

Crypto tokens function as a mechanism for promoting decentralization and open participation in the financial market, while also offering potential advantages such as increased efficiency, cost, and improved accessibility. By leveraging the decentralized and open participation properties of crypto tokens, Numerai is able to implement its business model.

NMR serves as the native cryptocurrency on the Numerai platform, where it incentivizes users to contribute by creating predictive models that outperform others. Furthermore, the token allows users to vote on platform changes and participate in governance decisions, promoting decentralization and community involvement.

In addition, Numerai employs a staking system that follows the “skin in the game” principle, which requires participants to put up a stake to be eligible for rewards. If their predictions prove accurate, their stake remains, and they earn additional rewards. However, if their predictions turn out poorly, they incur a loss of the value of tokens staked, known as “burning”. By implementing this model, Numerai builds trust between the platform and participants, ultimately creating a collaborative environment for successful investing.

Conclusion

Overall, Numerai’s innovative approach to investing highlights the potential for machine learning to revolutionize the investment industry. As more hedge funds and investment firms embrace machine learning and data-driven strategies, it is likely that we will continue to see a shift towards more collaborative and decentralized approaches to investing. The future of finance is undoubtedly exciting, and it is clear that machine learning will play a significant role in shaping it.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/