Introduction

Tokenization, the process of creating digital representations of assets on a blockchain, is reshaping the financial industry. By offering efficiency, transparency, and security, this technology holds immense potential. However, understanding its current state and the data underpinning its growth is crucial for stakeholders.

The Tokenization Landscape

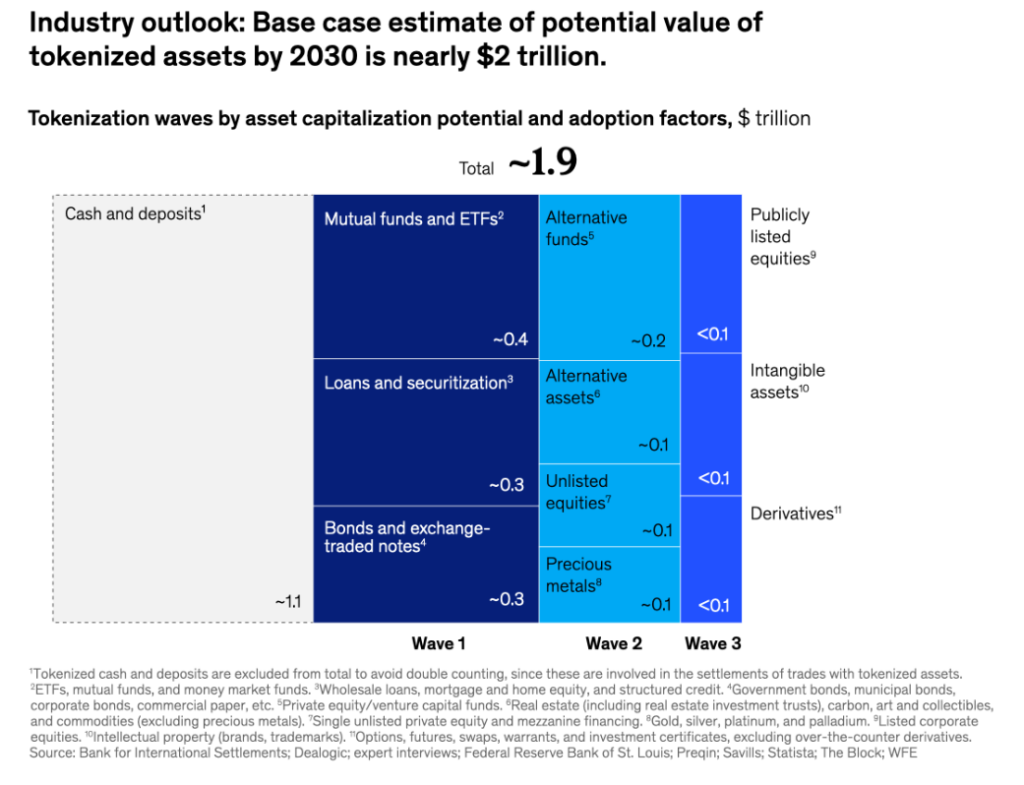

While the concept of tokenization is gaining traction, concrete data on its scale and impact is still emerging. A McKinsey report by Partner Anutosh Banerjee and colleagues predicts that tokenization will unfold in phases, with assets like cash, deposits, mutual funds, ETFs, loans, and bonds leading the charge.

The report estimates the potential value of tokenized assets could reach nearly $2 trillion by 2030. This projection underscores the technology’s transformative potential. However, it’s important to note that this is a forward-looking estimate, and the actual realization will depend on various factors including regulatory developments, technological advancements, and market adoption.

The Regulatory Challenge

A significant hurdle to widespread tokenization adoption is the regulatory landscape. The nascent nature of the technology has led to a patchwork of regulations across jurisdictions. This regulatory uncertainty creates challenges for businesses and investors seeking to participate in the tokenization ecosystem.

Key regulatory issues include:

- Securities classification: Determining whether a token is a security or a commodity has significant implications for compliance and investor protection.

- Consumer protection: Ensuring that investors are adequately protected from fraud and market manipulation is essential for building trust in the tokenization market.

- Taxation: Establishing clear tax rules for tokenized assets is crucial for preventing tax evasion and ensuring fair treatment of taxpayers.

- Anti-money laundering (AML) and counter-terrorist financing (CTF): Implementing effective AML and CTF measures for tokenized assets is essential for maintaining financial integrity.

To foster innovation while mitigating risks, a clear and harmonized regulatory framework is necessary. This would provide a level playing field for businesses, protect investors, and promote the growth of the tokenization industry.

The Road Ahead

Tokenization’s future hinges on continued research, development, and collaboration. As the technology matures and regulatory frameworks evolve, we can anticipate a surge in tokenized assets and innovative financial products.

To fully grasp tokenization’s impact, comprehensive data collection and analysis are essential. Tracking metrics like market size, asset classes, investor demographics, and regulatory developments will be instrumental in understanding this evolving landscape.

By addressing regulatory challenges, fostering innovation, and leveraging data-driven insights, the tokenization industry can unlock its full potential and contribute to the transformation of the financial system.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/