Together with…

Cryptocurrencies are becoming more and more popular as an investment asset, but many people are still uncertain about how to invest safely. Cryptocurrency exchanges are useful for interacting with the blockchain, but there have been a few scandals, including the most recent one of FTX, that have raised concerns about their reliability. Indeed, there are several risks associated with cryptocurrency exchanges, such as the vulnerability of computer systems, liquidity issues, regulatory uncertainties and the reliability of the exchange itself.

In recent years, many different crypto platforms have emerged, including centralised and decentralised exchanges, as well as regulated marketplaces that enable trading in cryptocurrency-based financial products (securities).

Investment tools

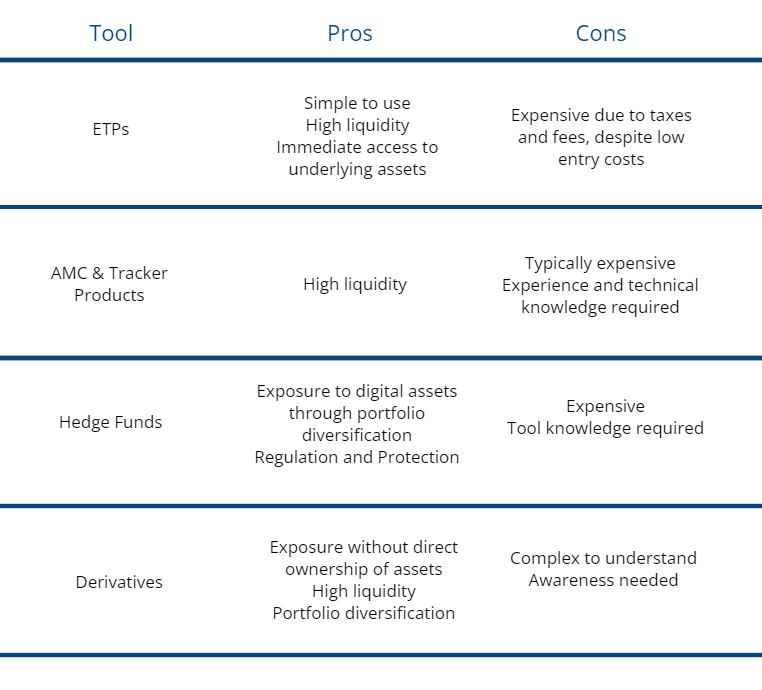

There are various instruments for investing in cryptocurrencies, allowing regulated access to the market, and increasing portfolios. Some of the main tools are ETPs, AMCs, crypto hedge funds and derivatives on crypto assets.

ETPs (Exchange Traded Products) are a type of collateralised investment product, where the issuer must guarantee ownership of the cryptocurrencies that are traded. ETPs are financial instruments that are traded like stocks on a stock exchange; their performance is linked to the performance of an underlying asset, which can be a stock market index, an individual security, a commodity or other.

Actively Managed Certificates (AMCs) or tracker products are structured regulated products, which can be listed or unlisted; in these products, the investment can either be directly in cryptocurrencies or strategies with cryptocurrencies as underlying.

Crypto hedge funds are another type that ensures investments are regulated and can involve assets like cryptos, but also decentralised finance strategies and Web3; in addition, investors’ asset classes are protected by applying various hedging strategies.

Another tool to access digital assets in a regulated way are derivatives, including CFDs, futures and options, which certainly address a more advanced clientele. In particular, CFDs, (Contract For Difference) are a type of derivative financial instrument that allows investors to speculate on the variation of the underlying asset’s price, in practice allowing them to open a buy or sell position on an asset, without actually owning it.

Each option has its own risks, costs, and strengths, which are summarised in the table.

Exchange-Traded Products

ETPs (Exchange-Traded Products) can potentially provide an alternative to the use of exchanges for those looking for cryptocurrency exposure. These exchange-traded financial instruments allow users to take positions on specific assets or investment strategies and, in particular, ETPs based on cryptocurrencies hold several properties that could meet the needs of those hesitant to use exchanges.

Some of the most important properties include:

- User-friendliness: ETPs are simple financial instruments that can be bought and sold like any other asset, without the need to understand complex blockchain technologies or manage digital wallets. In contrast, crypto exchanges require a certain degree of technical knowledge and can be complicated for beginners to use.

- Diversification: possibility to diversify one’s portfolio with a single trade. Gaining exposure to multiple cryptocurrencies without having to manage several digital wallets.

- Indirect exposure: ETPs give the opportunity to gain exposure to cryptocurrency prices without having to possess cryptocurrencies physically. This means that investors can benefit from cryptocurrency price movements without having to manage the risks associated with digital wallet custody, fraud or trading platform outages.

- Regulation: crypto ETPs are regulated financial instruments authorised by regulatory authorities, offering investors greater security than traditional crypto exchanges that operate in a ‘young’ and unregulated environment.

- Transparency: these instruments are often sponsored by companies that offer greater transparency on their activities and products than traditional crypto Exchanges.

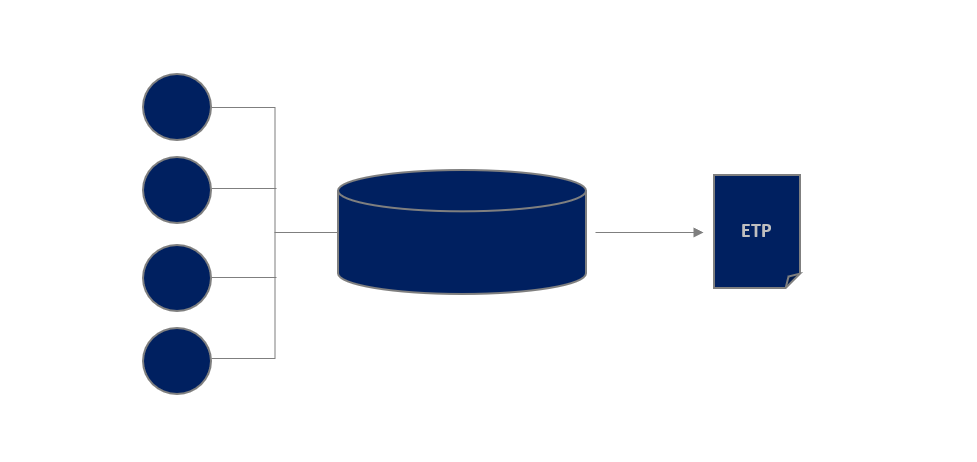

ETPs structure

ETPs investors do not have direct ownership of the underlying cryptocurrencies, but rather hold shares or units of the ETP itself. The ETP issuer is responsible for managing the underlying assets and must provide exposure to cryptocurrency price fluctuations, which is typically done through the use of derivatives or other financial instruments.

In a crypto ETP, the custody of cryptocurrencies is typically handled by a third party, which is responsible for safekeeping digital assets. The custodian can be either specialised in digital assets or in traditional custody banks. The role of the custodian, specifically, is to store safely and securely the private keys associated with cryptocurrencies; in addition, this subject may also provide insurance cover to protect against the loss or theft of digital assets.

Final considerations

Clearly, even though crypto ETPs offer numerous advantages over traditional crypto exchanges, it is still necessary to carefully evaluate the custodian of the assets. This is because, in case the custodian suffers a cyber-attack or commits fraud, the cryptocurrencies making up the crypto ETP could be compromised, and investors could suffer financial losses.

Another specification concerns that investing in cryptocurrencies through the use of an ETP leads to the use of intermediaries and reliance on the regulations of traditional finance, i.e., ‘barriers’ that, theoretically, blockchain technology seeks to remove by leading to decentralisation.

To sum up, using ETPs to gain indirect exposure to cryptocurrencies without worrying about asset management is certainly a valid alternative to using exchanges, but it is not a solution that completely removes counterparty risk (especially custodian risk).

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/