Together with…

What are securitized products?

Our article on Collateralized Loan Obligations (CLOs) introduced a type of securitized financial product. The aim of this article is to explain, in simple and general terms, how the process of securitization works. In particular, we will focus attention on the specific case of CLOs.

The process of securitization involves the transformation of illiquid financial assets into tradable and liquid securities. This transformation occurs through a process of pooling together different assets, such as home equity loans, to create a financial product marketable to investors. If it is true that such products have been associated with being the cause of the 2007-08 financial turmoil, increased regulation both in the U.S and under the European and British jurisdictions, has led securitized financial products to gain immense popularity. Securitized products are closely linked to the concept of making individual retail-sized loans and lines of credit more appealing to institutional investors. Indeed, when packaged together and sold as bonds, securitized loans become easily tradable and are particularly appealing to both retail consumers, who gain reduced-cost access to the credit they require, and institutional investors, who now have the opportunity to diversify their portfolios beyond the realm of traditional corporate and government bonds.

In other words, the process of securitization allows the transferring of credit risk to those investors willing to bear it.

The steps to create a securitized product

In its simplest form, securitization is a two step process.

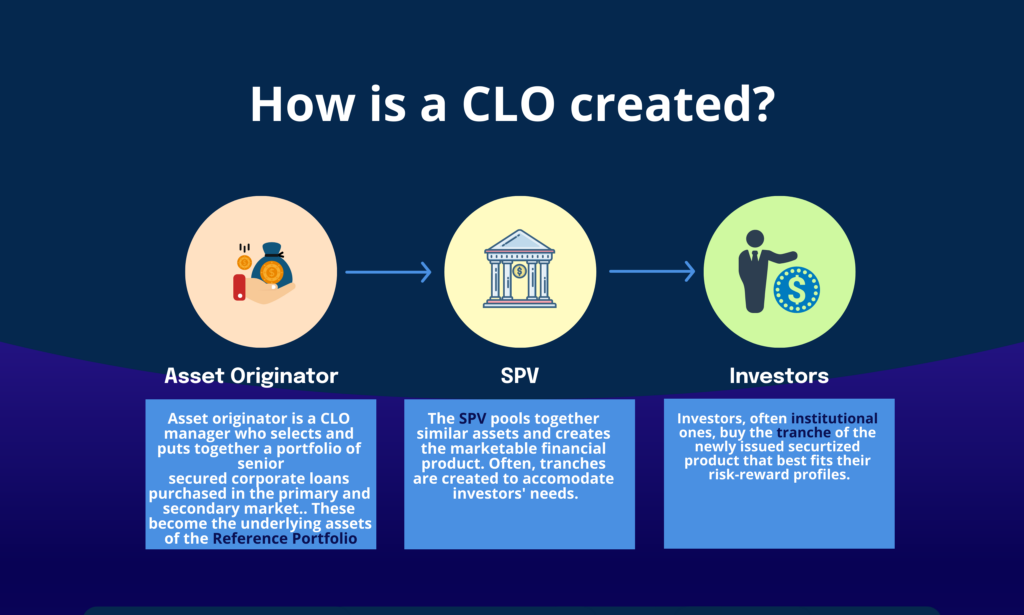

It begins when the originator, a lender or a firm with income-producing assets, selects a number of these assets and then arranges to sell the lot, often known as the “reference portfolio” to an investment bank or other financial institutions. This institution pools together these assets with comparable ones from other sellers and establishes a special-purpose vehicle (SPV), an entity set up specifically to acquire the assets, package them and issue them as a single security.

These securities are then sold to institutional or retail investors in the capital markets. The investors receive fixed or floating rate payments from a trustee account funded by the cash flows generated by the portfolio of assets. Sometimes the issuer (the SPV) divides the original asset portfolio into slices, called tranches. Each tranche is sold separately and bears a different degree of risk, indicated by a different credit rating. Evidently, riskier tranches- the so called equity tranches- are exposed to a higher possibility of losses on the underlying assets, but this increased risk is compensated with a higher risk premium. Conversely, the less risky ones- the Senior tranches- bear a lower level of risk and a lower level of risk premium. Often between the Senior and the Equity tranches there is a mezzanine tranche, which bears moderate risks and is compensated with moderate returns.

To clarify any possible doubt for the reader, we consider the example of Collateralized Loan Obligations. A CLO is a diversified portfolio of senior secured corporate loans, generally known as Broadly Syndicated Loans.

These loans are pooled together by a special purpose vehicle which then issues the CLO with its different tranches. Finally, the investors in the capital market buy this product as it generally allows for higher diversification and high risk adjusted returns.

Conclusion

To conclude, CLOs and securitized products in general, have become a means by which institutional investors diversify their debt portfolio as these products allow for high diversification and are accessible by investors with different risk profiles. Furthermore, the pooling of multiple assets together makes it enormously easier for institutional investors to manage their portfolio.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/