Together with…

Introduction

Collateralized Loan Obligations (CLOs) stand out as complex but powerful financial instruments in structured finance. They have attracted considerable attention from investors seeking diversified exposure to credit markets. Understanding both the geography of CLO markets and the key players within them provides valuable insights into the dynamics that characterize this corner of the financial world.

Within global financial centers, CLOs have gained a presence, most notably in some regions over others. This article will delve into the geographical distribution of CLO activity, highlighting where these financial instruments emerge the most.

Furthermore, the world of CLOs is dominated by various market players, from asset managers to rating agencies, shedding light on who the main participants in this world are. Through this exploration, we aim to provide readers with a comprehensive overview of where CLOs are predominantly traded, as well as the key players that determine their impact within the global financial ecosystem.

Global Distribution of CLOs: Key Regions and Market Players

In 2023, the global financial market encountered financial instability and elevated interest rates, as both the European Central Bank and the Federal Reserve signaled no rate cuts until mid-2024.

Focusing on the CLO market segment, future forecasts indicate growth expectations: the persistent pursuit of yield in a protracted low-interest-rate environment is expected to endure, thereby maintaining investor interest in CLOs.

Projections suggest indeed a Compound Annual Growth Rate (CAGR) of approximately 14% during the forecast period spanning 2023 to 2028.

CLOs emerged in the 1990s, but they remained overshadowed by more popular choices like RMBS and ABS, especially before the 2008 financial downturn. While RMBS and CDOs dominated the structured finance scene, CLOs maintained a relatively modest presence.

However, during the crisis, CLOs demonstrated resilience, mostly due to their diversification. Unlike the concentrated exposure of RMBS to the residential mortgage market, CLOs spread risk across different sectors.

Following the turmoil, there was a remarkable surge in the significance of CLOs within the U.S. financial landscape. The subsequent decade marked by historically low-interest rates saw both the CLO market and the leveraged loan market it depends on, nearly doubling in size. This expansion underscored the growing importance of CLOs as investors sought alternatives in the aftermath of the financial crisis.

U.S. Prevalence

The two main Regions leading the CLO Market are: United States and Europe.

The U.S. remains the country with the biggest portion of CLO market share and is expected to stay the leader in the years to come.

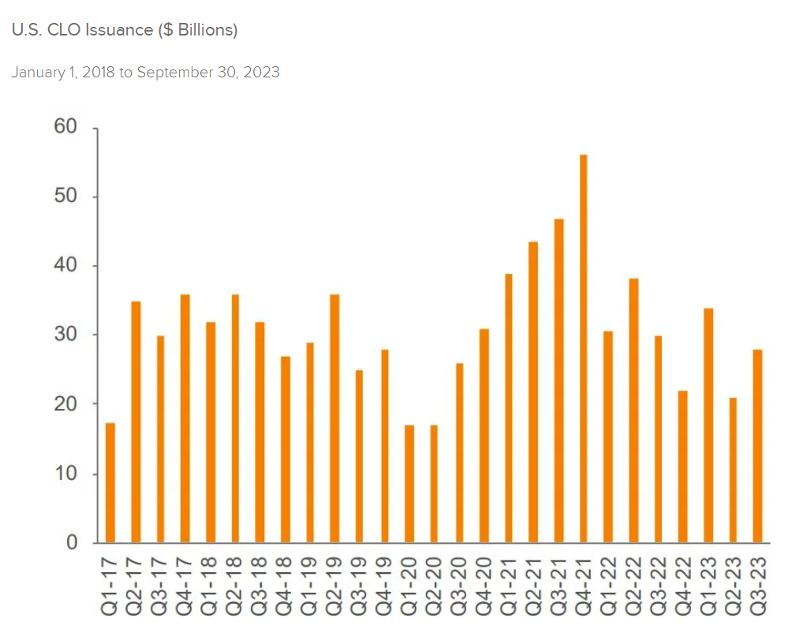

In the U.S., in 2023, CLO issuance reached $116 billion from 266 deals, marking a decline compared to both 2022 and 2021 figures, and aligning with 2019 levels, according to Trepp data.

While the US is leading in the CLO market maturity compared to other regions, several factors could have helped it to achieve that.

Noticeably, the US has had a highly established and rich financial ecosystem with great expertise and a strong track record in asset-backed securities. At the same time, the regulatory landscape in the United States is designed to allow for the creation and servicing of complex financial tools, including CLOs.

On the other hand, the European Collateralized Loan Obligation market generated in 2023 €26 billion from 69 deals (According to Trepp data), maintaining its performance from 2022.

Key Market Players

In the realm of financial markets of Collateralized Loan Obligation (CLO), a transaction represents a multi-layered operation involving several players. From the inception of the transaction to its execution and ongoing management, a multitude of actors converge, each contributing a unique expertise and perspective. These actors, ranging from institutional investors to banks, from asset managers to rating agencies, form a complex ecosystem vital to the functioning and evolution of the CLO market. Understanding the roles and interactions of these different participants is critical to understanding the complexities and importance of CLO transactions in contemporary finance.

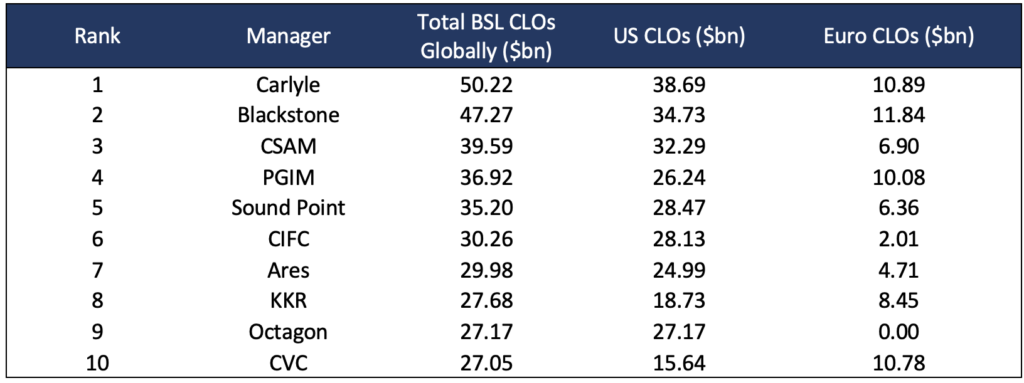

In the previous insight we went into the figure of the CLO managers, and their responsibilities and explained why they cover such a key function. If we had to rank and identify the top CLO managers globally, we could mention the ones listed below, according to Sound Point.

Another pivotal player in the realm of CLOs is the Arranger, who serves as both underwriter and placement agent for CLO securities. Specifically, an arranger plays a crucial role in structuring, underwriting, and placing CLOs in the primary market.

According to a ranking by 9fin, the top 10 US CLO Arrangers in 2023 are:

- BofA

- JP Morgan

- Citi

- Goldman Sachs

- Morgan Stanley

- Barclays

- RBC

- BNP Paribas

- Jefferies

- Nomura

Next, the Rating agencies: they assess and rate the credit risk associated with each CLO security. The primary agencies in the CLO market include S&P, Moody’s, and Fitch. They conduct detailed analyses of the financial soundness of the bonds within CLOs, considering factors like issuer stability, underlying loan credit quality, and default probabilities. Based on these assessments, they assign ratings reflecting the credit risk level of each security.

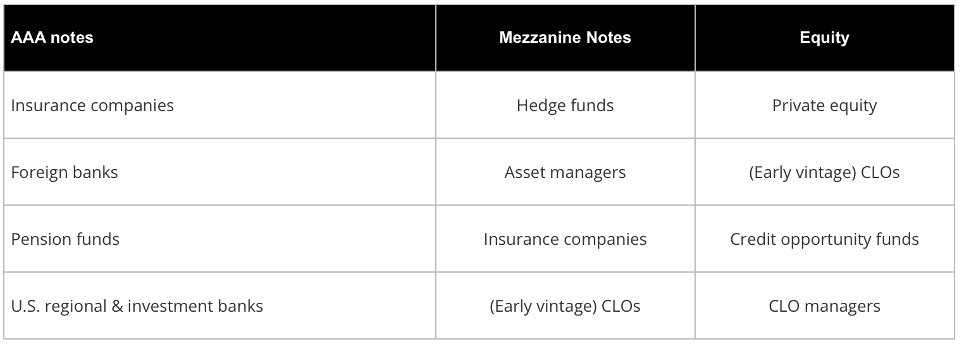

Lastly, there are the Investors, who acquire CLO securities; research conducted by the Federal Reserve reveals that a substantial portion of CLO investors are institutional.

The graphic below delineates the investor profile based on CLO tranches. Generally, insurance companies, banks, and pension funds secure the highest-ranking (often AAA or AA-rated) notes. Meanwhile, the riskier mezzanine notes and equity securities tend to be held by hedge funds, private equity funds, and CLO managers themselves.

Conclusion

In summary, Collateralized Loan Obligations (CLOs) represent a vital segment of structured finance and are mainly present in the US, followed by Europe, we also looked at the main figures involved, and which ones are recognized as most significant in the market.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/