Introduction

Commodities trading, an ancient and integral component of the global marketplace, has continuously evolved to play a pivotal role in modern investment strategies.

Commodities trading primarily deals with raw materials and primary agricultural products that are interchangeable. Commodities can be broadly categorized into two groups.

Soft Commodities:

- Agricultural Products (oats, say, soy flour, soybean oil, wheat, corn, cocoa, coffee, cotton, lumber, orange juice, tobacco, sugar and more)

- Livestock and Meal (this category includes all live animals)

Hard Commodities:

- Metals (gold, platinum, palladium and more. In times of economic uncertainty and crises, they often attract heightened interest as they are considered safe-haven assets)

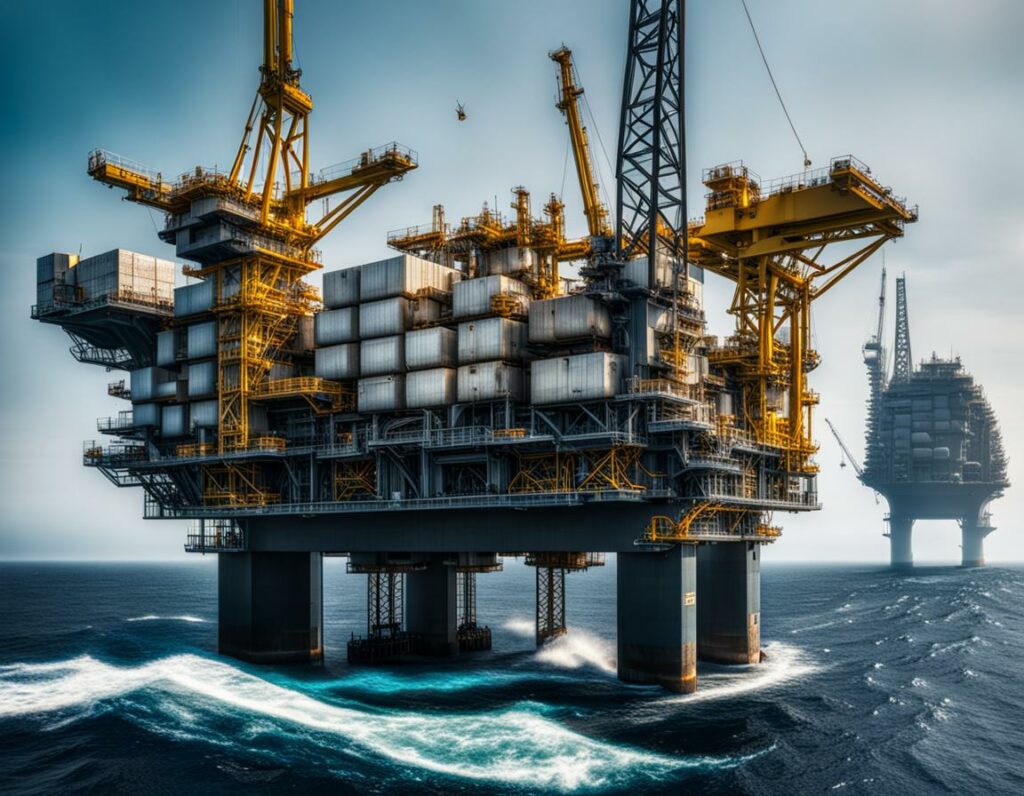

- Energy (oil, natural gas, coal, renewable energy)

Commodities markets

The commodities market is fundamentally driven by the principle of supply and demand. Changes in the supply of a commodity, whether due to factors like livestock diseases or poor crop harvests, have a direct impact on demand, thereby causing fluctuations in the commodity’s price.

Moreover, the market is significantly influenced by technological advancements and the introduction of alternative goods. These innovations can reshape industrial dynamics, leading to shifts in demand and supply patterns towards different commodities.

The role of politics is another crucial aspect in the commodities market. Political decisions can influence the price levels of commodities by altering import and export demands.

In this context, the economic strength or weakness of a region or country also plays a pivotal role. A weak economy leads to reduced demand for primary goods.

It’s worth noting that certain factors like climate conditions and natural disasters can further impact the supply curve, contributing to price increases.

Therefore, numerous factors can influence commodities markets and their price levels, resulting in distinct dynamics for each scenario. These influences impact both sectors of this market: it serves as a vital source for industrial sectors while also acting as a financial instrument for diversifying investors’ portfolios.

How to trade commodities

As mentioned, commodities in their various forms have always played a fundamental role in the global economy. Trading in these tangible assets has evolved into a diverse and dynamic arena. In the past, commodity trading was primarily accessible to a limited number of investors due to the significant amount of time required. However, with the evolution of financial markets, the introduction of new instruments, the proliferation of information, and advancements in technology, a broader range of investors has gained access to the commodity market. Today, the methods have evolved, providing more diverse forms of investment opportunities.

- Commodities Futures: They are typically used by commercial entities whose activities depend on commodities to reduce the risk of financial loss, keeping the price at a predetermined level. From another perspective, futures are the most common way to trade goods: by entering into a futures contract, the investor commits to buying a specific quantity of an asset and then reselling it at the predetermined maturity date, profiting from the spread in the price changes of the commodity.

- Physical Purchases : For commodities such as gold, platinum, and metals in general, one form of investment involves purchasing the physical commodity, which can include gold bars, jewelry, coins, and more. Typically, the prices of these types of goods increase in situations of potential or actual conflict, serving as a hedge to safeguard personal investments.

- Commodities Stock: This type of investment involves purchasing stocks of companies associated with commodities. These stock prices tend to align with the market performance of the underlying goods. However, stock prices are also influenced by the company itself, and if it is well-managed, the risk of loss in value is likely better mitigated by other aspects of the company. In this sense, stock prices are generally considered less volatile than future prices, making them easier to hold and trade. Moreover, financial information about companies is readily available to investors. The high liquidity of stocks is another appealing characteristic that attracts investors to the stock market. On the other hand, it’s important to note that stock prices are influenced by other external factors, which can be seen as a potential disadvantage.

- Mutual and Private funds: These funds pool money from numerous small investors to create a sizable portfolio aimed at tracking the price of a single commodity or a group of them. To achieve this, the fund can invest in futures contracts to follow the market price or invest in the stock of companies with exposure to that Commodity.

In addition, it’s important to note that ETFs and ETNs allow investors to profit from fluctuation of commodity prices without investing directly in futures contracts. Exchange-Traded Notes (ETNs) are unsecured debt securities structured to replicate the price fluctuations of specific commodities or commodity indices. ETNs derive their value based on the performance of the underlying assets and are supported by the issuing entity. There are also Commodity Mutual Funds; they invest in both stock market and in commodities proper, providing an easy exposure to the market avoiding the risks of directly trading in commodity futures.

Geopolitical crisis

As previously mentioned, commodities prices are intricately intertwined with political and geopolitical dynamics, especially in the realm of energy commodities. Notably, energy prices have exhibited a history of significant fluctuations in response to past military conflicts in the Middle East. In the recent context, according to the Commodity Markets Outlook from the World Bank in October 2023, we have witnessed a remarkable 9 percent surge in overall energy prices, and a 6 percent increase just in oil prices. Natural gas prices have witnessed a substantial additional increase of 35 percent.

Agricultural prices are forecast to decline by 7 percent in 2023, followed by a further 2 percent dip in 2024 and 2025, primarily due to ample supplies. The food and beverage sector is expected to experience a slightly more pronounced prices decrease, while agricultural raw materials are projected to rise by over 1 percent.

Additionally, base metal prices are anticipated to decrease by 5 percent in 2024, reflecting slowing demand, followed by a rebound in 2025 driven by the recovery of global industrial activity.

In summary, commodities prices, particularly energy prices, are closely connected with geopolitical dynamics. It is essential for investors to carefully assess investments that align with their interests and exercise caution when selecting the right financial instruments. Diversifying their portfolio is a prudent strategy to navigate this intricate landscape effectively.

Conclusion

In conclusion, commodities trading offers diverse investment opportunities influenced by many different factors. As we have already stated, diversification is crucial in managing risks and understanding these influences is essential for making wise investments decisions, in a world where commodity trading continues to play a crucial role.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/